Compliant: Built-In Controls That Align with Rules

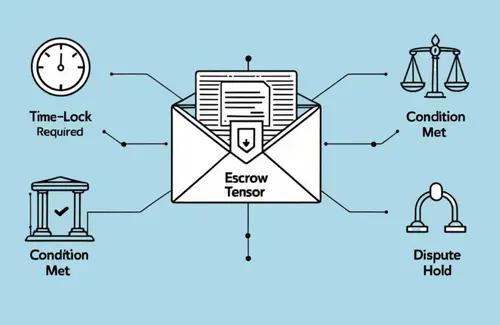

In traditional finance, compliance often means after-the-fact checks. With ProofPay Tensors, compliance is baked in at the Tensor level. From the moment it’s issued, a Tensor knows where it’s allowed, how it can be spent, and under what conditions — automatically.

You define the rules. The Tensor follows them — every time, everywhere.

What Does “Compliant” Mean?

A Compliant Tensor carries usage policies directly within itself. You can:

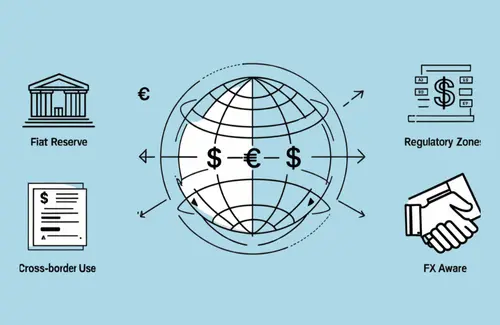

- Restrict where it’s spent — using geo-fencing

- Limit which vendors or categories are allowed

- Define a spend cap or daily/monthly usage limits

- Set expiry dates, after which it becomes unusable

- Prevent misuse by enforcing identity verification

The result? Funds that behave exactly as you intend, without needing external policing.

Use Cases for Built-In Compliance

| Use Case | Example |

|---|---|

| Government subsidy | Can only be spent on groceries, expires in 30 days |

| Corporate expense token | Usable only at approved vendors, capped at $300 |

| Parental control | Child’s Tensor limited to school supplies or transit |

| Cross-border transfer | Tensor expires if not redeemed in destination country |

| Charity grant | Usable only by registered beneficiaries, once per month |

Smarter Than Traditional Controls

Traditional systems rely on external databases and after-the-fact fraud checks. ProofPay Tensors enforce compliance at the point of use, making misuse extremely difficult and recovery easier when needed.

Built-in compliance helps:

- Reduce fraud and misuse

- Simplify audits and reporting

- Satisfy regulatory mandates

- Give users peace of mind when issuing tokens

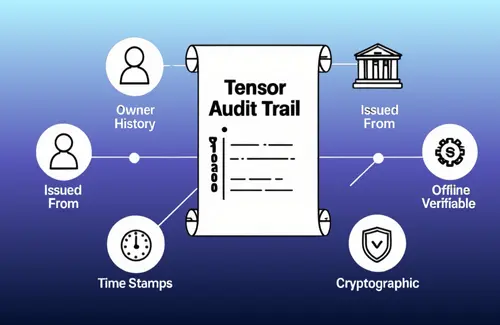

Auditability + Control = Trust

- Each Tensor is linked to the intended recipient

- Every restriction is transparently encoded

- Behavior is traceable and verifiable through Merkle-anchored records

- You control the rules — ProofPay enforces them

Bottom Line

ProofPay Tensors come with programmable guardrails — ensuring funds are used exactly as intended.

From financial inclusion programs to enterprise reimbursements, the Compliant Tensor is a game-changer for anyone who cares about control, accountability, and trust.

Disclaimer

All features, functionalities, and capabilities described above are part of the planned ProofPay platform roadmap. Their availability is subject to approval, licensing, or regulatory clearance from relevant government agencies and financial authorities in the jurisdictions where we operate. Certain features may be limited, delayed, or restricted based on regional compliance requirements. ProofPay reserves the right to modify, defer, or suspend any feature until such approvals are fully obtained.