Industry Competitor Disclaimer: Stablecoin Landscape Considerations

The information presented regarding competitors in the stablecoin industry is based on publicly available sources, market research, and comparative analysis as of the date of publication. This content is intended to provide a general overview of prevailing stablecoin models, business practices, and technological frameworks used by various market participants. It does not represent legal conclusions, regulatory determinations, or investment advice.

The stablecoin industry is diverse, fragmented, and rapidly evolving, comprising a wide spectrum of entities including but not limited to:

- Centralized issuers of fiat-backed stablecoins (e.g., USDC, USDT)

- Algorithmic stablecoin systems (e.g., DAI, Frax)

- Institutional bank-issued tokens (e.g., JPM Coin)

- Asset basket models (e.g., Reserve Protocol)

- Cross-chain stable assets (e.g., wrapped tokens, synthetic assets)

Each of these models varies widely in structure, compliance posture, and operational transparency. ProofPay acknowledges that many stablecoin competitors have contributed significantly to the evolution of digital currency infrastructure, but several critical differences and limitations remain prevalent in the current competitive environment:

1. Regulatory and Licensing Divergence

- Many competitors operate in legal grey zones or under jurisdiction-specific interpretations of financial law.

- Several are unlicensed in certain territories yet continue global operations via decentralized platforms, introducing regulatory uncertainties.

- Licenses held often reflect MSB or e-money status confined to limited jurisdictions, lacking global regulatory harmonization.

2. Transparency and Audit Limitations

- Published attestation reports are often not real-time or full-scope audits, and lack unit-level traceability.

- Reserves are disclosed summarily, limiting verification depth.

- Algorithmic stablecoins frequently lack verifiable backing assets.

3. Traceability and Fungibility Gaps

- Most stablecoins are fungible with no serial identifiers, impeding unit-level tracking.

- Fraud, theft, or intervention handling is limited to wallet-level blacklisting, risking collateral damage.

- Privacy-centric chains complicate regulatory enforcement.

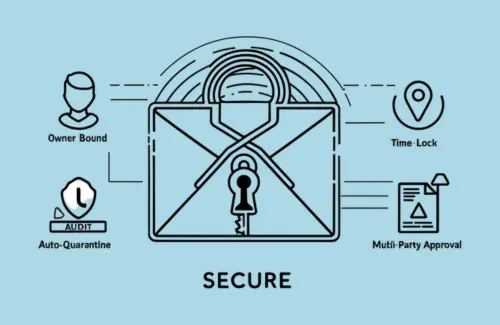

4. Limited Programmability for Real-World Use Cases

- Programmability is often confined to on-chain smart contracts or wallet-level controls.

- Missing capabilities include:

- Per-token usage rules

- Time-bound restrictions

- Vendor-locked payments

- Geofenced/conditional enforcement

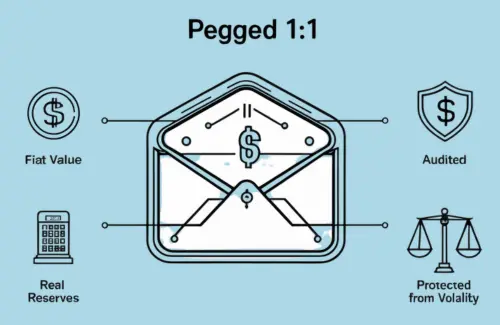

5. Volatility and Asset Backing Variability

- Algorithmic models are prone to de-pegging and volatility.

- Some use mixed reserves (e.g., crypto, commercial paper), adding credit risk.

- Weak regulatory oversight has led to controversies and enforcement actions.

6. Limited Offline Usability and Edge Case Support

- Most require live blockchain connectivity, and are non-functional in:

- Rural or remote areas

- Disaster zones

- Aircraft/maritime/military settings

- Offline-verifiable proofs are generally missing.

7. Market Behavior and Speculative Bias

- Most stablecoins serve exchange liquidity and arbitrage needs, not real-world transactions.

- This focus creates misaligned incentives and fuels regulatory scrutiny.

8. Governance and Oversight Challenges

- Some models lack transparent governance and clear escalation paths.

- DAOs often have no legal personality, complicating accountability.

- Centralized issuers retain discretionary freeze/blacklist powers without oversight.

Summary: ProofPay’s Differentiation

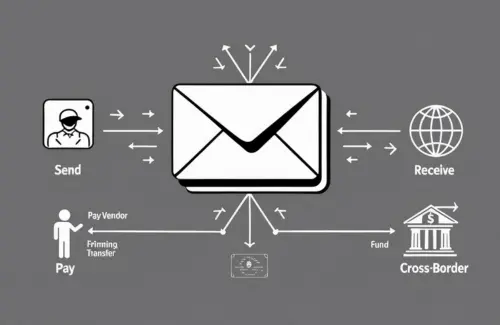

ProofPay addresses these gaps with a dual-layer architecture providing:

- Treasury-backed, fiat-pegged reserves under regulatory oversight

- Programmable, traceable, and purpose-driven Tensors

- Unit-level auditability using cryptographic proofs

- Built-in compliance mechanisms (per-Tensor rules, reversibility, escrow)

- Offline transaction support for disconnected environments

- Utility-first design for payments, not speculation

- Transparent governance aligned with financial standards

Conclusion: The stablecoin market is heterogeneous, with inconsistent standards across legal, technical, and operational dimensions. ProofPay delivers a next-generation solution that blends regulatory-grade stability with programmable flexibility, optimized for global payments, public programs, and financial inclusion — all without compromising auditability, security, or usability.