The ProofPay Protocol: A Dual-Layer Stablecoin System Combining Treasury-Backed Reserves, Programmable Tensors, and Traceable Tokens for Real-World Payments

By Raj Mars Marni, May 7, 2025

Executive Summary

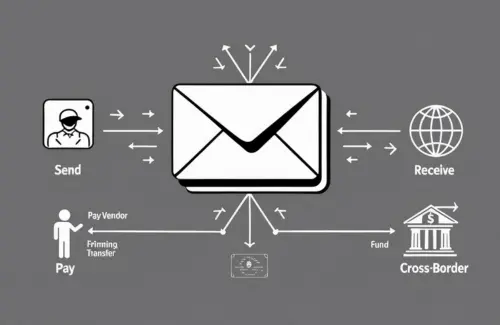

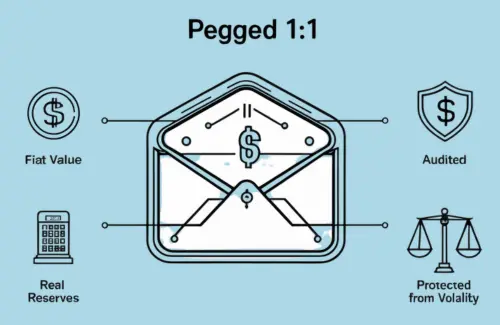

This document outlines a modern, auditable, and programmable digital stablecoin ProofPay System built on the ProofPay Protocol, leveraging a dual-layer architecture consisting of programmable Tensors and traceable Tokens. Unlike blockchain-based stablecoins, which use fungible account-based models, the ProofPay System introduces discrete Tokens with unique identifiers that reside within programmable Tensors, acting as smart envelopes. This dual structure enables fine-grained control, escrow, compliance, and programmable financial logic while bridging traditional financial infrastructure with blockchain networks. The ProofPay System functions independently in conventional financial environments while interoperating with blockchain ecosystems via the ProofPayLedger, offering unprecedented flexibility for next-generation payment applications.

1. Overview of the System's Design Philosophy

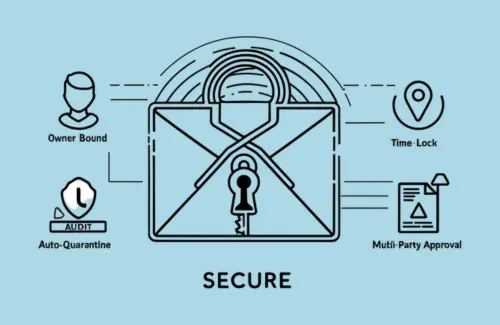

The ProofPay System applies a fundamentally different approach to digital money: each unit of value is represented as a Token with a unique identifier, embedded within a Tensor, which acts as a programmable container or envelope. Tensors are responsible for programmable behavior (e.g., restrictions, expiry, escrow), while Tokens ensure granular traceability and ownership control.

- Every Token has a unique identifier with immutable audit trails.

- Tokens are pegged to fiat currencies and always redeemable.

- Tensors have unique identifiers and govern programmable behavior.

- Transfers happen in whole units, preserving traceability.

- Tensors enforce purpose, time locks, and spending limits.

- ProofPayLedger maintains Merkle-tree anchored proofs for tamper-evident auditing.

- ProofPay operates off-chain with integrated blockchain interoperability.

2. Key Advantages of the Dual Architecture

2.1 Token-Level Auditability

Every transaction ties back to specific Tokens, creating per-unit traceability.

2.2 Tensor-Level Programmability

Tensors provide embedded programmable logic, enabling escrow, spending restrictions, expiry, and geographic control.

2.3 Layered Flexibility

Tokens act as permanent audit records while Tensors flexibly apply use cases and restrictions.

2.4 Regulatory-Grade Compliance

Granular Token-level traceability and Tensor-level programmability ensure compliance with AML, KYC, and financial reporting.

2.5 Human-Centric Financial Controls

Users can apply programmable controls via Tensors while retaining secure, audit-proof Tokens inside.

3. High-Value Use Cases

- Regulated Subsidies and Vouchers: Governments can issue Tensors containing Tokens usable only at approved vendors with expiry dates and regional locks.

- Family & Education Budgeting: Parents create Tensors pre-programmed for educational spending.

- Corporate Perks & Health Wallets: Employers issue Tensors restricted to health, wellness, or commuting expenses.

- Programmable Escrow Transactions: Tensors act as escrow with programmable release conditions.

- Multi-Currency Token Holding: Users hold multi-currency Tokens within Tensors supporting international use cases.

- Transparent Grants and Institutional Funding: NGOs receive purpose-bound Tensors ensuring funds are used for defined projects.

- Time-Locked Rewards and Incentives: Tensors with unlock dates support vesting and loyalty programs.

- Offline Validation Support: Tensors and Tokens verifiable offline using Merkle-based proofs.

4. Implementation Strategy & Roadmap

4.1 Phased Adoption

- Phase 1: Pilot Tensors with government vouchers and corporate perks.

- Phase 2: Expand to family budgeting and multi-currency use cases.

- Phase 3: Enable cross-border programmable remittances and NGO grants.

4.2 Regulatory and Institutional Partnerships

Engage regulators, auditors, and financial institutions early to standardize dual-layer compliance models.

4.3 Developer Ecosystem Enablement

Provide SDKs for developers to integrate Tensor-Token infrastructure into applications.

5. Governance, Oversight, and Control

5.1 Role-Based Governance

Issuers, administrators, and regulators control Tensor programming rights, while Token issuance remains governed by reserve backing and audit policies.

5.2 Anti-Fraud and Risk Controls

Real-time freezing of Tensors or Tokens, expiry enforcement, and programmatic recall ensure integrity.

5.3 Open Auditing Framework

Third-party auditors can validate Token circulation and Tensor compliance without compromising privacy.

6. Conclusion

The ProofPay Dual Architecture redefines programmable money through the synergy of programmable Tensors and traceable Tokens. It combines usability with regulatory-grade trust, offering an auditable, programmable, and human-friendly digital currency model for the modern economy.

Disclaimer

All features, functionalities, and capabilities described above are part of the planned ProofPay platform roadmap. Their availability is subject to approval, licensing, or regulatory clearance from relevant government agencies and financial authorities in the jurisdictions where we operate. Certain features may be limited, delayed, or restricted based on regional compliance requirements. ProofPay reserves the right to modify, defer, or suspend any feature until such approvals are fully obtained.