Why ProofPay Changes Everything for Stablecoin Users

Over the years, stablecoins like USDC and USDT have changed how people think about money. They brought the promise of fast digital payments without the price swings of typical cryptocurrencies. Yet, for all their progress, these stablecoins remain fundamentally limited. At their core, they are simply digital representations of dollars, stripped of any context, history, controls or fraud elimination.

ProofPay offers a departure from this model. It redefines what digital money can be, transforming it from a dumb store of value into smart programmable money that knows its purpose, tracks its history, operates according to embedded rules while eliminating fraud. For users, this represents a complete upgrade in how money can work for them—safer, more transparent, and more purposeful.

The Problem with Today’s Stablecoins

Spend any time with USDC or USDT and you’ll quickly see the limitations. A wallet displays a simple balance—1,000 USDC or 500 USDT—and that’s it. There’s no indication of where the money came from, how it’s meant to be used, or whether it carries any conditions. Every dollar looks and behaves identically, regardless of its history or source.

This design creates well-known problems. Parents cannot easily control how children spend digital allowances. Companies struggle to track specific funds through their financial systems. Compliance teams must rely on external attestations and audits to prove ownership and usage. Worst of all, in the event of fraud or disputes, there’s no inbuilt mechanism to prove or trace ownership of funds in a court of law.

ProofPay Brings Money to Life

ProofPay introduces a fundamentally different model: every unit of value is assigned a unique identity through what it calls Tensors. A Tensor is a smart, programmable container for digital money, and unlike traditional stablecoins, every Tensor carries its own history, purpose, and set of usage rules.

When you look at your ProofPay wallet, you don’t just see a number—you see the story behind every dollar you own. You know exactly when each Tensor was created, who previously held it, and how many times it changed hands before arriving in your account. This historical traceability introduces a level of transparency and security never before possible in digital payments.

Built-In Protection Against Misuse

Perhaps most striking for everyday users is how ProofPay allows money to follow rules defined by its sender. Imagine a parent sending a child money that can only be spent at the school cafeteria. Or an employer issuing a bonus that must be used at designated health vendors. With ProofPay, these are not theoretical possibilities—they are standard features.

Because these rules are enforced at the token level, recipients cannot override or bypass them. This removes guesswork and significantly reduces the risk of misuse, especially in settings where money is intended for specific purposes.

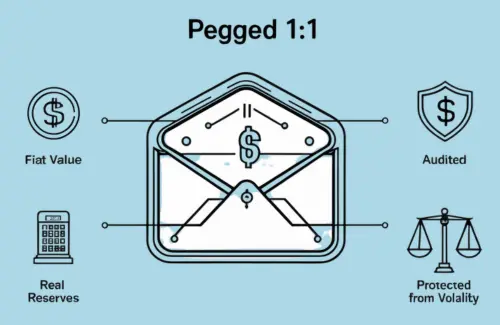

Verifiable Ownership Without Blind Trust

One of the most overlooked flaws of traditional stablecoins is the reliance on external promises. Users must trust that a centralized issuer holds the correct reserves and that their internal records are accurate. With ProofPay, this dependency disappears.

Ownership records are published to a blockchain in near real-time, providing public, cryptographic proof of who owns which Tensor and when. If ever challenged, a user can independently demonstrate that they owned a specific Tensor at a given point in time—without relying on a private company’s word. This system offers stronger legal standing and transparency compared to traditional stablecoins.

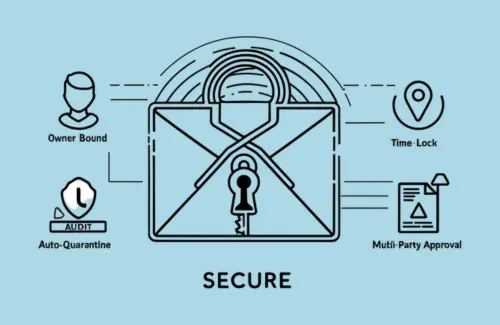

Resilience Against Fraud and Theft

ProofPay also resolves a long-standing problem in digital assets: the inability to recover or protect individual units of value. In most stablecoin systems, if a hacker gains access to your account, they can drain your entire balance instantly, with little recourse.

With ProofPay, each Tensor is tracked individually. Specific Tensors can be quarantined, blocked, or frozen without impacting unrelated funds. This granularity allows quicker response to fraud, reduces systemic risk, and enables more sophisticated dispute resolution, especially in cases of theft or error.

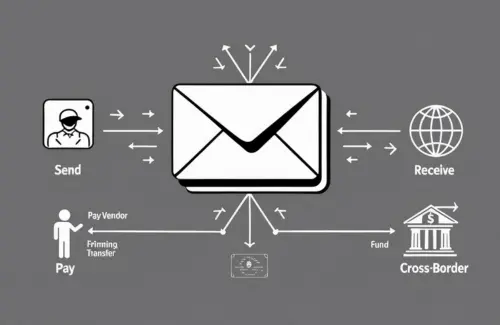

Clarity in Multi-Currency Transactions

Cross-border payments are another area where ProofPay shines. Typical multi-currency wallets show balances in different denominations but leave users in the dark about the timing of currency conversions or the rates applied.

ProofPay eliminates this ambiguity. Each Tensor records its original currency, the exchange rate at the time of creation, and its intended usage. This clarity is especially useful for businesses and individuals making regular international transactions, providing an audit trail that can withstand regulatory scrutiny.

Why ProofPay Marks a New Era

The impact of ProofPay is more than just technical. It changes how people relate to money itself. By bringing transparency, control, and proof directly into the fabric of digital payments, it enables users to send and receive value with confidence and clarity. For parents, businesses, international travelers, and compliance-driven organizations, this translates to money that is safer, smarter, and more aligned with their intentions.

Traditional stablecoins succeeded in making money faster. ProofPay goes further by making money intelligent.

Conclusion

For too long, stablecoins have promised innovation while maintaining outdated assumptions about how money should function. ProofPay delivers the next evolutionary step—a system where every dollar carries meaning, purpose, and protection.

With new laws on digital assets from various govt. agencies, financial integrity and transparency are more important than ever, ProofPay offers a vision of digital money that empowers its users, rather than limiting them.

Disclaimer

All features, functionalities, and capabilities described above are part of the planned ProofPay platform roadmap. Their availability is subject to approval, licensing, or regulatory clearance from relevant government agencies and financial authorities in the jurisdictions where we operate. Certain features may be limited, delayed, or restricted based on regional compliance requirements. ProofPay reserves the right to modify, defer, or suspend any feature until such approvals are fully obtained.