ProofPay and the Three Functions of Money: Smart Money Meets Classical Economics

Money has always served three foundational roles in human society: it is a medium of exchange, a store of value, and a unit of account. These timeless functions make money useful for everyday life, for saving wealth, and for measuring economic transactions. However, in the digital age—especially with the rise of stablecoins—many of these functions have become fragmented, opaque, and vulnerable to misuse. ProofPay offers a fresh approach that restores and enhances the classical role of money, adapting it for modern needs with security, transparency, and programmability built in.

Medium of Exchange: From Basic Transfers to Purposeful Payments

At its core, money should facilitate exchange—helping people pay for goods and services quickly and reliably. Traditional stablecoins succeed in speed but often fail in purpose. Most are primarily used for crypto trading, not everyday commerce. They cannot distinguish between spending for groceries, gambling, or gray-market activity, which creates risk for users and businesses alike.

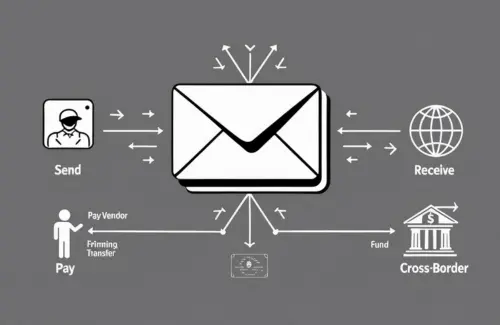

ProofPay fundamentally reimagines the exchange function. By using Tensors, each payment carries meaning. Individuals can send money with usage restrictions, such as funds for specific merchants, locations, or time periods. Businesses can issue employee benefits or customer rewards that work only under predefined conditions. This makes ProofPay not only a tool for fast payments but also a system for intent-driven, compliant commerce—enabling secure exchanges aligned with the purpose of the transaction.

Store of Value: Stability With Transparent Security

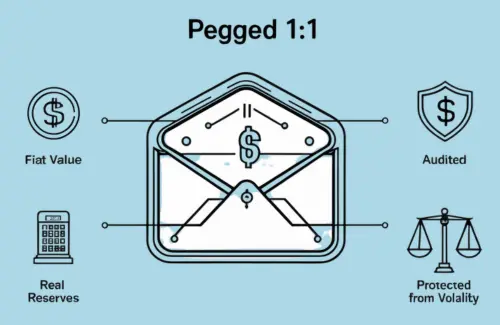

Money must also serve as a store of value, maintaining purchasing power over time. Traditional stablecoins claim to offer this by pegging to fiat currencies like the dollar or euro. Yet, users are often asked to trust opaque systems, with only occasional attestations and limited insight into reserves.

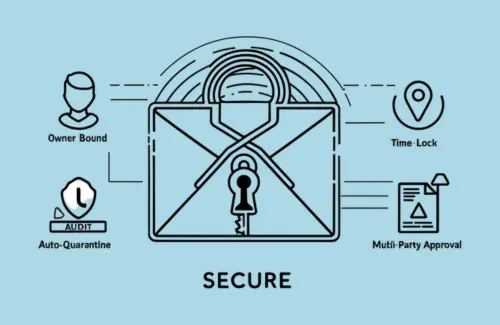

ProofPay enhances this function by combining fiat pegging with continuous transparency. Every Tensor is individually traceable, anchored to blockchain-published ownership snapshots, and supported by cryptographic audit trails. This allows users to not only hold value but also verify its backing at any point in time. With programmable controls, users can protect funds from misuse, expiry, or theft—ensuring money remains safe and usable when needed. ProofPay thus elevates the store-of-value function from a passive feature to an active financial safeguard.

Unit of Account: Clear, Multi-Currency Accountability

Finally, money serves as a unit of account, allowing people to measure value and price goods. Stablecoins in principle fulfill this role by representing fiat currency amounts, but in practice, they offer little clarity. Multi-currency wallets show balances in numbers without context—users are left guessing about conversion rates, transfer origins, and applicable restrictions.

ProofPay addresses these shortcomings through tensor-level accounting. Each Tensor carries its own metadata: creation date, currency denomination, exchange rate, and applicable usage rules. This makes accounting straightforward and verifiable. Individuals know exactly what their funds are worth, where they originated, and how they can be used. For businesses and institutions, this granularity simplifies financial reporting, regulatory compliance, and cross-border transactions. ProofPay transforms money into a clear, auditable unit of account, tailored for both personal and professional use.

Conclusion

The digital age demands more from money. Fast transfers alone are no longer enough—users need security, purpose, and transparency. ProofPay brings the three classical functions of money into the 21st century, combining them with programmability and auditability. It is money that not only moves quickly, but moves intelligently; that not only stores value, but protects it; and that not only measures worth, but makes it visible and accountable.

ProofPay isn’t just a new payment system—it’s a restoration of money’s full purpose, built for a digital world.

Disclaimer

All features, functionalities, and capabilities described above are part of the planned ProofPay platform roadmap. Their availability is subject to approval, licensing, or regulatory clearance from relevant government agencies and financial authorities in the jurisdictions where we operate. Certain features may be limited, delayed, or restricted based on regional compliance requirements. ProofPay reserves the right to modify, defer, or suspend any feature until such approvals are fully obtained.