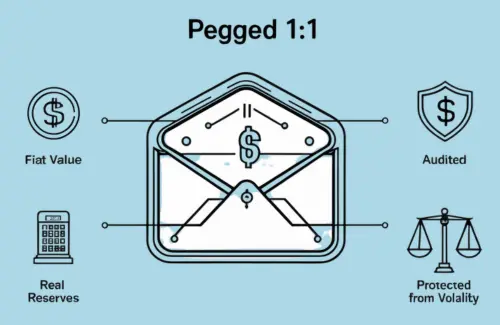

Full-Backed Stability for Every ProofPay Token

At the heart of the ProofPay system lies a commitment to absolute financial stability through transparent, fully-backed treasury reserves. The Treasury Reserve section of Public Records and Reports provides comprehensive disclosures of the real-world assets held in custody to back each issued Tensor and Token within the ProofPay ecosystem.

Our reserve management approach goes beyond industry norms, delivering a safer, more transparent, and regulator-friendly foundation for programmable digital value.

Our Reserve Commitment: Fully-Backed, Fully-Verified

- Strict 1:1 reserve policy — every Tensor and Token is fully backed by liquid, verifiable assets.

- $1 USD Tensor = $1 in fiat reserve, always.

- Currency-matched reserves for all issued denominations (USD, EUR, INR, etc.).

- Assets held under regulated treasury frameworks with transparent custody.

Treasury Reserve Composition

- High-quality liquid assets (HQLA) such as:

- Short-term government securities (e.g., U.S. T-bills, EU sovereign debt)

- Central bank reserves or regulated bank deposits

- Cash equivalents aligned with global accounting standards

- Excluded assets:

- No corporate bonds or unsecured debt

- No crypto-collateral

- No unverified off-chain assets

- Structure designed to:

- Eliminate credit and counterparty risk

- Prevent exposure to market volatility

- Ensure instant redemption liquidity

Public Treasury Reporting Cadence

- Weekly reserve balance reports by currency

- Monthly attestations by licensed auditors

- Quarterly reserve composition breakdowns with allocation percentages

- Annual third-party reserve audits following IFRS/GAAP standards

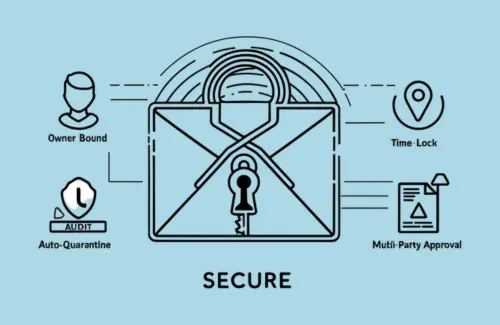

Transparency and Verification Features

- Daily Merkle-root proofs of reserve snapshots anchored on-chain

- Downloadable proof files for public, third-party verification

- Real-time dashboards for issuance-to-reserve tracking, open to:

- Retail users

- Institutional partners

- Regulators and compliance teams

Global Reserve Segmentation

- Currency-specific pools (USD, EUR, JPY, etc.) to match issuance denominations

- Region-specific audits to ensure compliance with local regulations

- Flexible treasury strategy aligned with national and global standards

Regulatory and Compliance Alignment

- Designed to comply with:

- EU MiCA Reserve Requirements

- U.S. Stablecoin proposals (e.g., TRUST Act)

- MAS DPT regulations (Singapore)

- FCA e-money standards (UK)

- Segregated accounts, regulatory filings, and third-party reserve audits are standard practice

Addressing Market-Wide Reserve Challenges

- ProofPay eliminates typical industry risks such as:

- Opaque reserve composition

- Illiquid or risky financial assets

- Lack of real-time transparency

- Redemption failures under stress

- We provide:

- Real-time public proof-of-reserve validation

- Blockchain-anchored audit data

- Enforceable redemption guarantees

- Multi-jurisdictional compliance safeguards

Summary: The ProofPay Reserve Difference

The Treasury Reserve section of our Public Records and Reports is a living, verifiable record of financial stability and transparency. It demonstrates:

- True 1:1 reserve backing for every issued token and tensor

- Multi-level reporting — daily, monthly, quarterly, and annual

- On-chain anchoring of all reserve disclosures

- Safe, regulator-approved asset classes

- Liquidity on-demand — even in high-stress market conditions

This model isn’t just about compliance — it’s a principled foundation for global trust and stability in programmable digital money.