Transparent Supply and Circulation Reporting

At ProofPay, we believe that full visibility into the issuance and distribution of our programmable stablecoins is essential to building trust, compliance, and operational integrity. The Market and Denomination section of Public Records and Reports delivers detailed, real-time insights into the quantity, structure, and geographic circulation of ProofPay Tensors across supported currencies and jurisdictions.

This transparency serves multiple objectives:

- Ensure public confidence in issuance discipline

- Enable regulatory oversight of market-level supply

- Support user and partner understanding of denomination availability

What the Market and Denomination Reports Cover

- Geographic Market Distribution

- Currency Denomination Distribution

- Value Denomination Breakdown

- Market Access Status

- Issuance and Redemption Flows

Geographic Market Transparency

Each Tensor is tagged at issuance with a market of origin and bound by jurisdiction-specific regulations.

- Active Markets List: Fully approved and operational regions

- Restricted Markets List: Jurisdictions with blocked or limited usage

- Pending Markets List: Regions awaiting licensing or under regulatory review

This structure empowers:

- Retail users with usage clarity

- Institutions with regional legal visibility

- Regulators with geographic issuance data

Currency Denomination Visibility

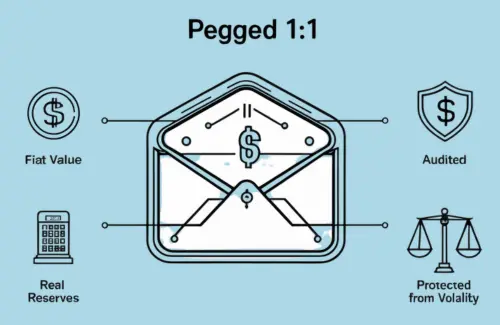

ProofPay issues Tensors natively in multiple fiat currencies to support local and international use cases.

- Total supply by currency (USD, EUR, JPY, INR, etc.)

- Reserve allocation per currency (linked to Treasury Reserve disclosures)

- Issuance trends across currencies, reflecting market demand shifts

This ensures treasury-backed stability and accurate reserve matching for every unit issued.

Value Denomination Breakdown

Unlike fungible-only stablecoins, ProofPay issues Tensors by value band to match real-world needs:

- Small denominations: $1, $5, €10 — for micro-payments, everyday use

- Medium denominations: $50, $100, €200 — for consumer and SME payments

- Large denominations: $500, €1000, ¥50,000 — for enterprise and institutional flows

Reports show:

- Circulating supply by denomination

- Issuance trends by value band

- Retail vs. institutional demand segmentation

Transparency Cadence and Reporting Frequency

- Daily dashboards via the ProofPay Explorer Portal

- Weekly summary reports by market and currency

- Monthly reports detailing penetration, denomination drift, and flows

- Quarterly disclosures aligned with reserve attestations

Regulatory and Public Utility

- Enables regulatory review and audit support

- Assists governments and public sector programs with cross-border financial flow analysis

- Equips consumers with visibility into availability and usage

- Helps partners plan payment services, manage liquidity, and monitor issuance risk

Why Market and Denomination Transparency Matters

Stablecoin ecosystems have faced criticism for:

- Opaque circulation and redemption data

- Unmonitored offshore flows

- No clarity on face-value breakdown

This has led to bans, trust issues, and compliance violations.

ProofPay resolves these challenges through live, public, auditable Market and Denomination reports that enable responsible, trustworthy issuance.

Summary: Responsible Issuance with Full Supply Visibility

The Market and Denomination section of ProofPay’s Public Records and Reports delivers:

- Clear geographic and currency supply distribution

- Transparency on issuance structure and redemption trends

- Regulatory alignment across supported jurisdictions

- Live data for partners, users, and policymakers

This visibility is central to ProofPay’s commitment to transparent, inclusive, and responsible programmable money.