Regulatory Alignment and Responsible Financial Operations

At ProofPay, compliance is not an add-on or a checkbox — it is a built-in architectural pillar. The Compliance section of Public Records and Reports offers a transparent overview of ProofPay’s adherence to global financial regulations, including:

- Anti-Money Laundering (AML)

- Counter-Terrorist Financing (CFT)

- Know Your Customer (KYC)

- Sanctions enforcement

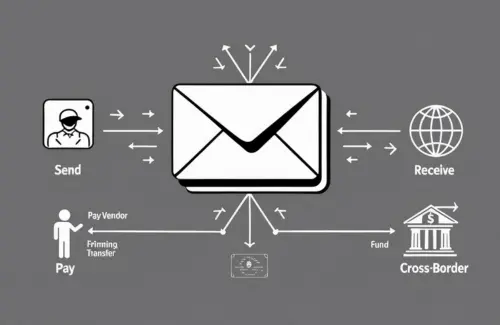

- Cross-border payment regulation

- Digital asset licensing frameworks

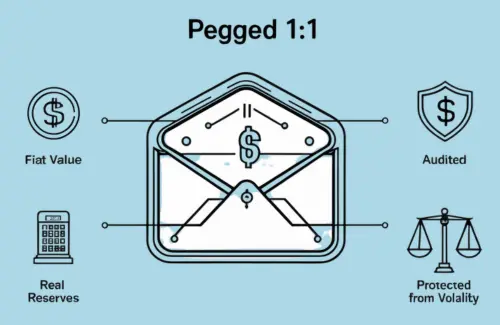

Our mission is to create a regulator-aligned stablecoin ecosystem that promotes transparency, fairness, and accountability for users of all types — from individuals to institutions.

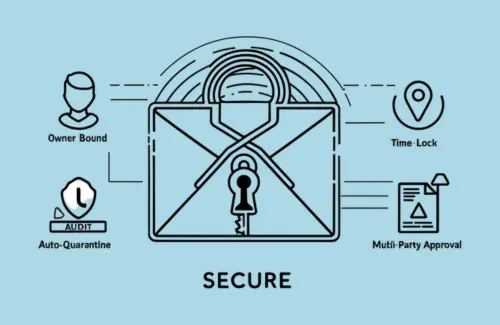

Compliance by Design: Embedded in the Technology

- Tensor-layer enforcement of programmable compliance rules

- Automated compliance engines for real-time validation

- Blockchain-anchored audit trails for external verification

This integrated model reduces reliance on intermediaries and enables transparent, consistent enforcement.

Key Compliance Components

1. AML/CFT Controls

- Tensor-level AML screening with sanctions and PEP list checks

- Real-time transaction flagging and quarantine functionality

- Automated behavioral risk detection

2. KYC & Identity Verification

- Jurisdiction-specific KYC tiers: Simplified for small amounts, full KYC for high-value usage

- Integration with verified eID, biometrics, and liveness providers

- Continuous re-verification lifecycle for evolving risk profiles

3. Geo-Fencing and Usage Controls

- Location-aware Tensor enforcement

- Adaptive spend rules by region and activity

- Compliance with banned jurisdiction rules and capital controls

4. Sanctions Compliance and Blocklisting

- OFAC, UN, FATF, and EU sanctions list integration

- Tensor- and account-level freeze capabilities

- Public accountability via blocklist disclosures

Compliance Reporting Transparency

- Quarterly Compliance Reports including:

- KYC account totals

- Flagged transactions and quarantines

- Annual Regulatory Filings Overview with licensing disclosures

- Incident Reporting Summaries for compliance escalations and sanctions actions

- Governance updates on changes to compliance processes or policy logic

Regulatory Coverage and Licensing Roadmap

- EMI/PI Licenses (Europe) under MiCA and PSD2

- Money Transmitter Licenses (United States)

- Major Payment Institution License (Singapore, under MAS)

- PSP registration across APAC and Africa

- Global VASP registrations aligned with FATF Travel Rule

Features not yet approved in a given region will be regionally restricted until fully compliant.

Governance and Compliance Oversight

- Internal Compliance Office reporting to a Board-level committee

- External legal advisors and compliance consultants per region

- Independent third-party audits of compliance operations

- Participation in global policy forums like ACAMS and Global Digital Finance

Why Compliance Transparency Matters

Industry failures in sanctions, AML, and KYC have led to:

- Fines and legal enforcement

- Platform bans in major jurisdictions

- Public trust degradation

ProofPay’s compliance infrastructure is built to prevent these outcomes through:

- Day-one regulatory readiness

- Auditable and transparent processes

- Proactive regulatory engagement

- Global scalability with legal confidence

Summary: ProofPay’s Compliance Commitment

The Compliance section of Public Records and Reports offers:

- Live insights into ProofPay’s compliance operations

- Proactive disclosures on risk and regulation alignment

- Proof of embedded, enforceable, auditable controls

ProofPay isn’t just a digital money platform — it’s a globally viable, regulator-ready financial system committed to responsible innovation, consumer protection, and legal sustainability.