ProofPay Platform Features Disclaimer

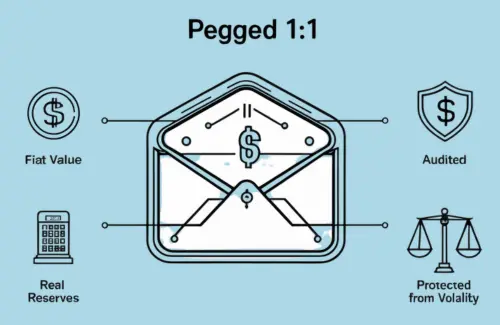

The features, functionalities, and capabilities described herein reflect the intended direction of the ProofPay platform and represent a planned technology and product roadmap. This roadmap outlines the conceptual design and intended evolution of ProofPay’s financial products, including but not limited to Tensors, programmable payment features, escrow functions, audit systems, and cross-border financial services.

The inclusion of any specific feature or capability in this roadmap does not constitute a commitment to immediate availability, nor does it imply unconditional deployment across all jurisdictions. The ProofPay platform operates in the highly regulated financial services sector, where the introduction of certain features is contingent upon obtaining formal approvals, licenses, or authorizations from relevant financial regulators, central banks, payment authorities, and government agencies.

Due to the diverse legal and regulatory frameworks that govern financial products in different countries and regions, the following conditions apply:

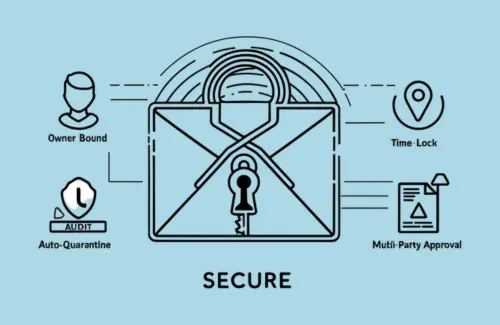

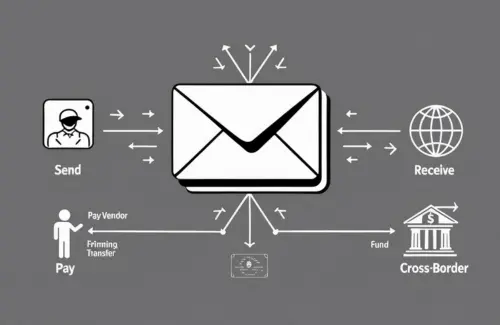

- Regulatory Approval Dependency: Features such as programmable spending restrictions, escrowed digital payments, offline verification methods, and cross-currency transfers are subject to scrutiny and approval by banking regulators, payment system operators, financial market authorities, and consumer protection agencies.

- Jurisdiction-Specific Limitations: Some features may be fully operational in certain jurisdictions while being restricted, modified, or withheld in others due to local financial licensing laws, capital controls, anti-money laundering (AML) regulations, and consumer protection standards.

- Licensing Requirements: ProofPay may be required to secure money transmitter licenses, e-money institution authorizations, or other specialized financial licenses prior to offering key features in specific markets.

- Phased Feature Rollout: The availability of individual features may follow a phased rollout strategy, where pre-approved modules (e.g., fiat-pegged Tensors) may launch first, while complex programmable features (e.g., geo-fenced spending, automatic reversibility) are introduced incrementally based on regulatory feedback.

- Continuous Compliance Review: All features remain subject to ongoing regulatory review and audit, and ProofPay reserves the right to modify, suspend, or delay any planned feature to comply with updated legal interpretations, rule changes, or policy advisories issued by global regulators.

- Consumer Safeguards Priority: ProofPay prioritizes financial integrity, security, and consumer protection, and will not release features prematurely without sufficient assurance that they meet or exceed legal compliance and ethical responsibility standards in each operating region.

Therefore, all product descriptions are indicative of future potential, subject to the evolving landscape of regulatory approvals, compliance mandates, and jurisdictional licensing clearances. The official release, availability, and functionality of any feature will only occur after necessary legal and regulatory prerequisites are satisfied.

ProofPay explicitly reserves the right to amend, defer, or cancel the release of any feature, in part or whole, pending these legal and compliance validations.